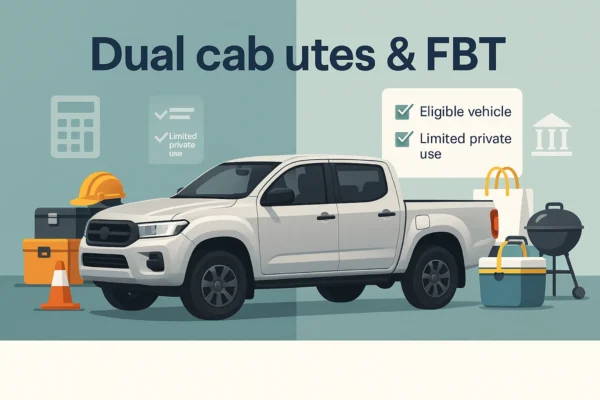

The ATO wishes to dispel the ‘common myth’ that dual cab utes are automatically exempt from fringe benefits tax (‘FBT’). If an employer provides dual cab utes to staff to complete their duties and the vehicle is available for personal use, then the benefit may be subject to FBT.

The ATO wishes to dispel the ‘common myth’ that dual cab utes are automatically exempt from fringe benefits tax (‘FBT’). If an employer provides dual cab utes to staff to complete their duties and the vehicle is available for personal use, then the benefit may be subject to FBT.

By understanding how their employees use their dual cab utes, employers can work out if FBT applies and meet their FBT obligations.

To qualify for an exemption, the dual cab ute must be an ‘eligible vehicle’. That is, it must be designed to carry a load of one tonne or more, or more than eight passengers (including the driver), or a load under one tonne and not primarily designed for carrying passengers.

The dual cab ute must also only be used for limited private use (i.e., minor, infrequent and irregular), such as the occasional trip to the tip or helping a mate move house.

If an employee’s personal use of the dual cab ute does not meet both of the above exemption conditions, then the employer will be liable for FBT.

Proudly partnered with the Tax Practitioners Board for expert, compliant support, contact us here.