When data does not match, the ATO may contact tax agents and their clients to find out why.

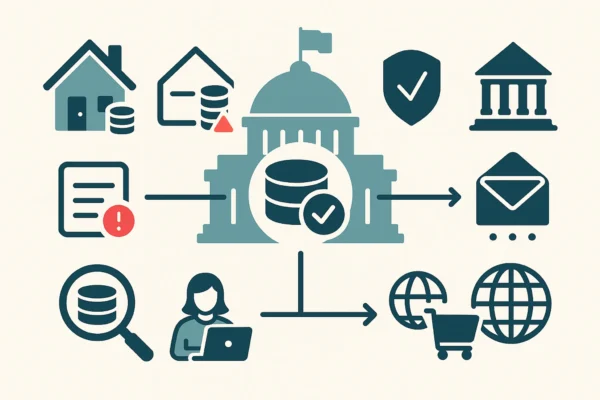

Rental Income Data-Matching

Over the coming months, the ATO will be sending letters where its data indicates:

- tax returns including rental income may need to be lodged for specific years; or

- rental income should be included in previously lodged tax returns.

Editor: Please contact us if you receive such a letter.

Offshore Merchant Data-Matching Program

The ATO will acquire merchant data from the big four Australian banks (ANZ, Commonwealth Bank, National Australia Bank and Westpac) for the 2025 to 2027 income years.

The ATO estimates that records relating to approximately 9,000 offshore merchants will be obtained each financial year.

Proudly partnered with the Tax Practitioners Board for expert, compliant support, contact us here.