Miscellaneous

Year-end (and other) staff parties Editor: With the well earned December/January, and Christmas parties & gifts 2025 on the way, many employers will be planning to reward staff with a celebratory party or event. However, there are important issues to consider, including the possible FBT and income tax implications of providing ‘entertainment’ (including Christmas parties) to […]

The Administrative Review Tribunal (‘ART’) recently held that some sales of subdivided farmland were subject to GST as they were made by the taxpayer in the course of carrying on an enterprise. The taxpayer owned farmland near Adelaide. He entered into an agreement with a developer, under which the developer sought rezoning and development approvals, […]

Release authorities are documents issued by the ATO to super funds, authorising the release of money from a member’s super account to pay specific liabilities, including in relation to excess concessional contributions, excess non-concessional contributions, and Division 293 tax assessments. The ATO is seeing a rise in SMSFs that receive a release authority and are […]

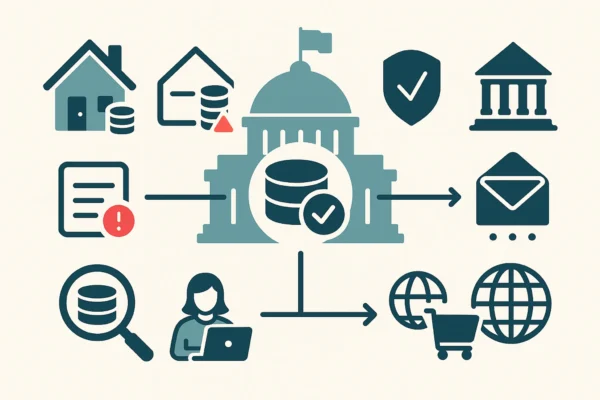

The ATO acquires and uses data for pre-filling, detecting dishonest or fraudulent behaviour, and identifying areas where it can educate taxpayers to help them understand their tax obligations. When data does not match, the ATO may contact tax agents and their clients to find out why. Rental Income Data-Matching Over the coming months, the ATO […]

The ATO is ‘detecting and addressing’ recurring errors in specific industries when businesses have a turnover between $1 million and $10 million. These industries include property and construction (including builders, contractors and tradies), and professional, scientific and technical services (including engineering, design, IT and consulting professionals). In these industries, the ATO continues to see recurring […]

Taxpayers can claim a tax deduction for most business expenses, provided they meet the ATO’s three ‘golden rules’: The expense must be for business use, not for private use. If the expense is for a mix of business and private use, they can only claim the portion that is used for business. They must have […]