Latest News

Managing Business Cash Flow

| | | The ATO has issued a reminder to businesses that paying regular attention to their record-keeping and reporting tasks will help them better manage their cash flow and allow them to plan for the future. The best way to make sure a business has enough cash available to meet its tax and other […]

Beware Of Scams

| | | Scamwatch is warning that scams cost Australian consumers, businesses and the economy hundreds of millions of dollars each year and cause serious emotional harm to victims and their families. Cryptocurrency scams are the most ‘popular’ type of investment scams, representing over 50% of losses. Often the initial investment amount is low (between […]

ABN Intent To Cancel Program

| | | The ATO is reviewing Australian business numbers (‘ABNs’) to identify potentially inactive ABNs for cancellation, and it has introduced a new automated process to allow taxpayers (or their tax agents) to confirm if their ABN is still required via a secure voice response system. An ABN may be selected if the taxpayer […]

Super Is Now Following New Employees

The ATO is reminding employers that, as of 1 November 2021, there is an extra step they may need to take to comply with the choice of super fund rules. If a new employee does not choose a super fund, most employers will need to request the employee’s ‘stapled super fund’ details from the ATO […]

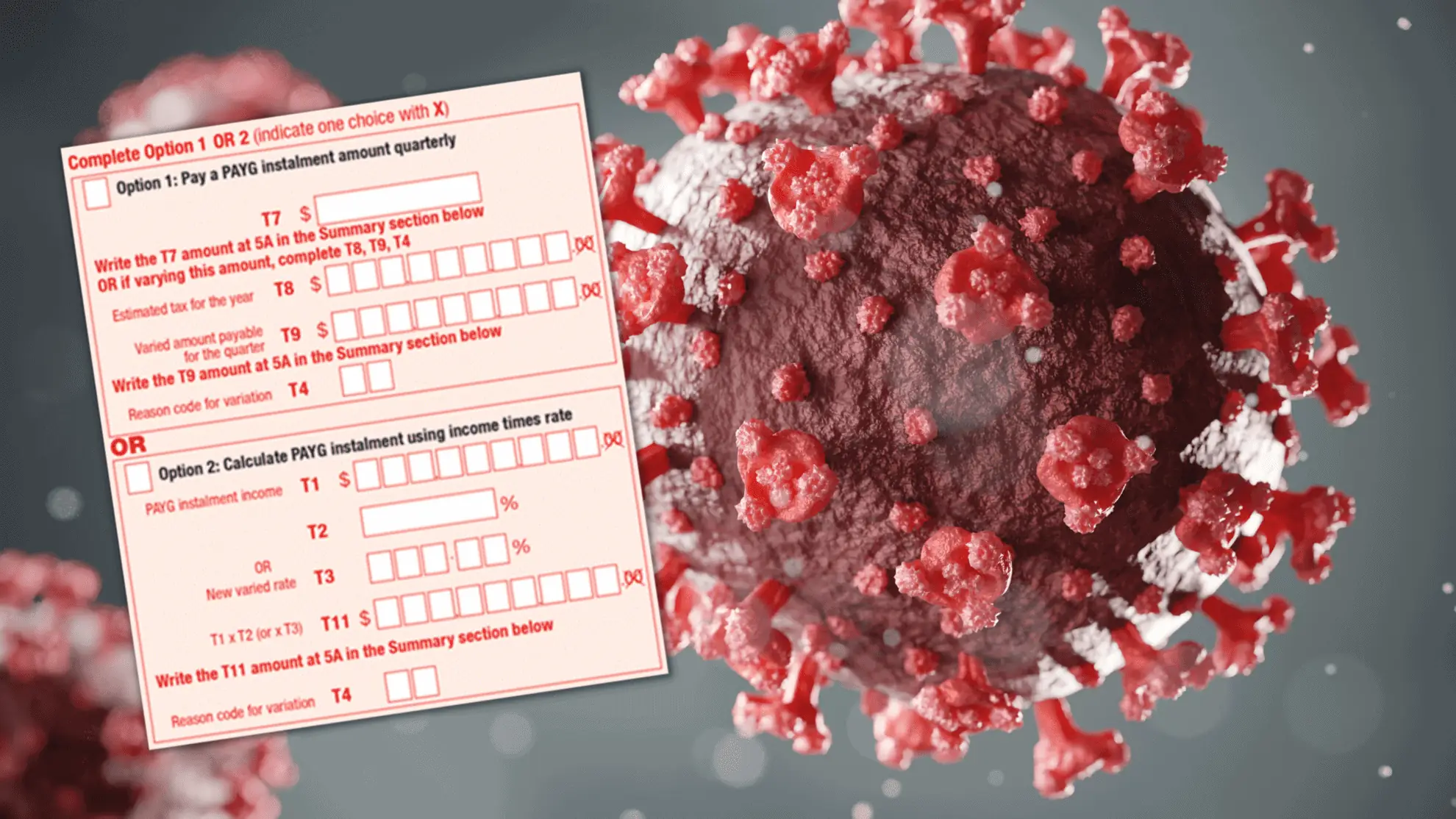

Permanent Changes To AGMs And Electronic Communications

The Government has introduced into Parliament a Bill to permanently allow companies to use technology to meet their regulatory requirements, and ensure that companies can continue to meet their obligations amid the uncertainty of the COVID‑19 pandemic. These reforms build on the recently renewed temporary relief, which we reported in September 2021, and which will […]

What’s New For Taxpayers

Before you complete your tax return for 2015, there are some changes you should be aware of in case they affect you. Mature age worker tax offset You can no longer claim the Mature age worker tax offset (MAWTO) in your tax return. Previously, to be eligible for the offset you needed to be an […]

Travel between home and work and between workplaces

While trips between home and work are generally considered private travel, you can claim deductions in some circumstances, as well as for some travel between two workplaces. If your travel was partly private and partly for work, you can only claim for the part related to your work. What you can claim You can […]

Gifts and donations

You can only claim a tax deduction for gifts or donations to organisations that have the status of deductible gift recipients (DGRs). Deductions for gifts are claimed by the person that makes the gift (the donor). For you to claim a tax deduction for a gift, it must meet four conditions: The gift […]

Capital gains tax checklist

The following questions will help you to identify possible capital gains tax (CGT) obligations. If you answer ‘yes’ to any of these questions, CGT may apply. Some questions are intended to highlight the possibility of a capital gain or loss arising in the current year, others to alert you to the possibility of a […]

Tax on Super Contributions

The tax you pay on your super contributions generally depends on whether the contributions were made before or after you paid income tax, you exceed the super contributions cap or you are a very high-income earner. Before-tax super contributions The super contributions you make before tax (concessional) are taxed at 15%. Types of before-tax contributions […]

Zone Tax Offset – exclude ‘fly-in-fly-out’

In the 2015–16 Federal Budget, the government announced that it will exclude ‘fly-in-fly-out’ and ‘drive-in-drive-out’ (FIFO) workers from the Zone Tax Offset where their normal residence is not within a ‘zone’. Currently, to be eligible for the Zone Tax Offset, a taxpayer must reside or work in a specified remote area for more than 183 […]