Latest News

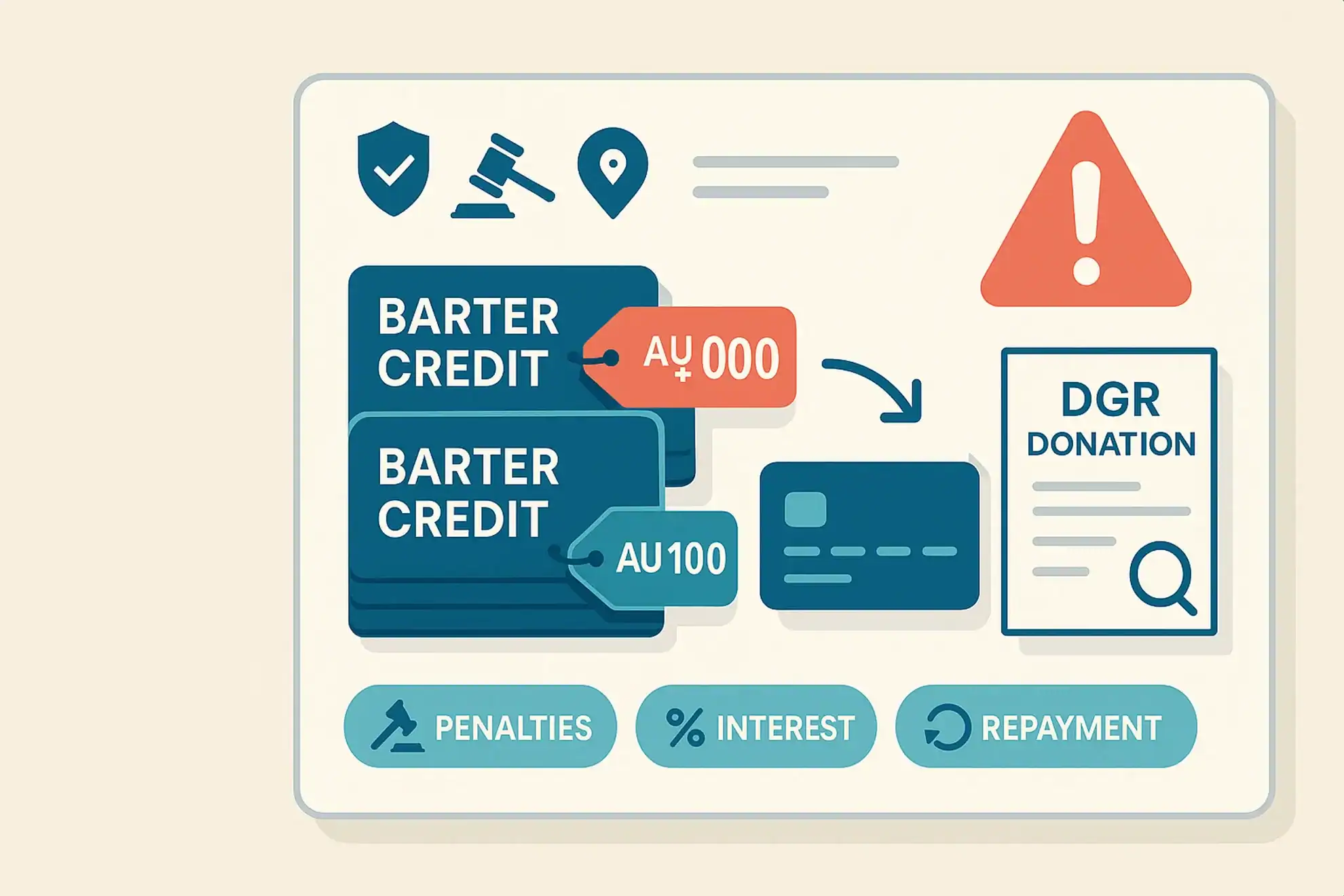

ATO warns about barter credit tax scheme

The ATO is warning the community to steer clear of an emerging tax scheme involving barter credits — a type of alternative currency used in some business networks. A tax scheme that involves artificially inflating deductions for donations of barter credits to deductible gift recipients (‘DGRs’) is on the rise. While it may seem enticing, […]

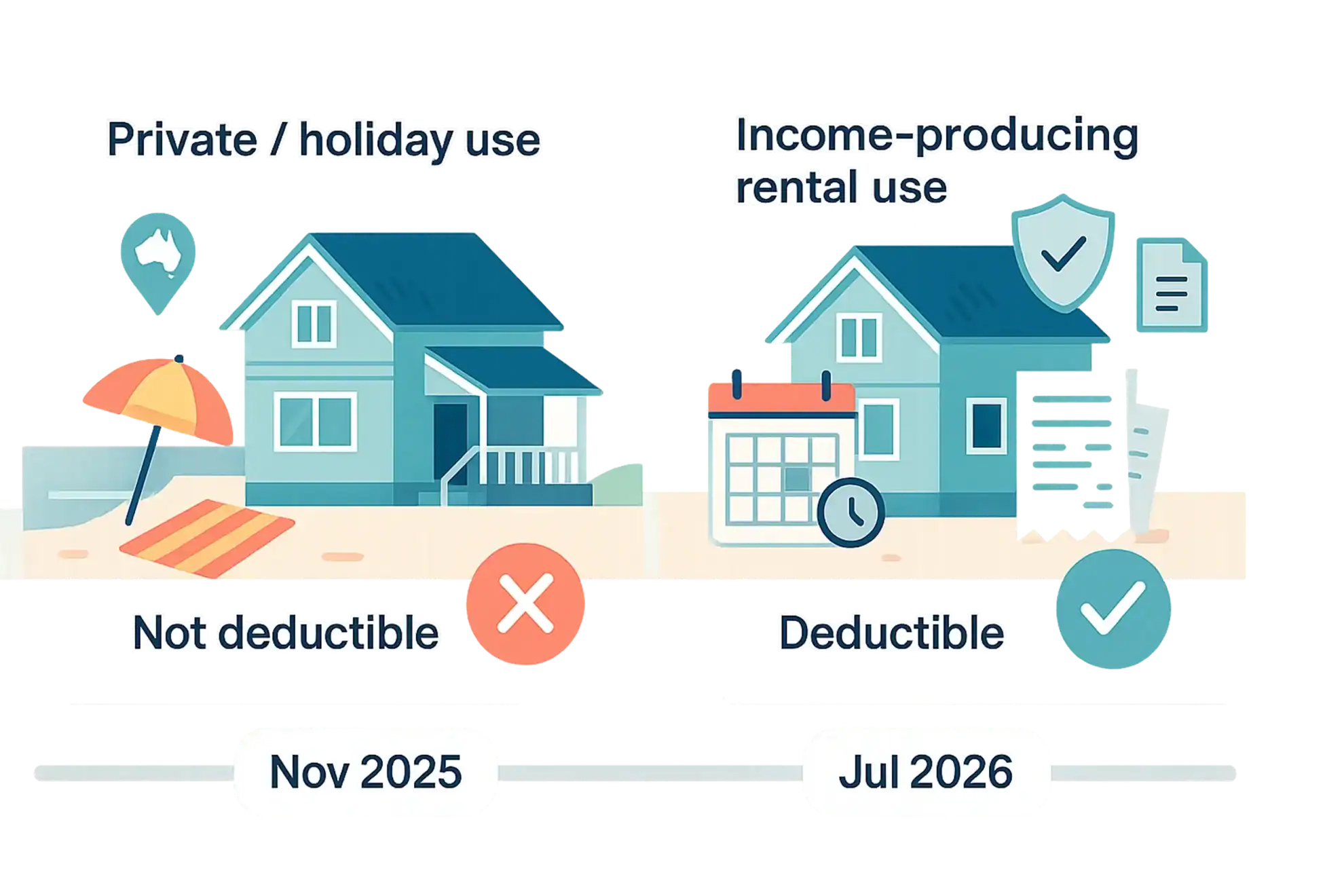

ATO’s new approach to holiday home expenses

The ATO has announced that it will take a somewhat different approach in relation to holiday home expenses that are claimed in relation to holiday homes. Broadly, the ATO now takes the view that, if a taxpayer’s rental property is also their holiday home, certain deductions relating to holding it will be completely denied (rather […]

Australians call out tax dodgers in record numbers

The ATO has hit a major milestone of over 300,000 tip-offs from the community about tax dodgers and other dishonest behaviours since 1 July 2019. In the 2024/25 financial year alone, almost 50,000 red flags were raised by members of the community who spotted something suspicious. Most of the tip-offs received related to shadow economy […]

Dental expenses are private expenses

The ATO has been seeing a number of deduction claims for dental expenses this tax time. Dental expenses are private expenses, including preventative and necessary dental treatment, medical expenses and other costs relating to client’s personal appearance (such as teeth whitening, makeup, skin care, shaving products and haircuts) are not deductible. These expenses are generally […]

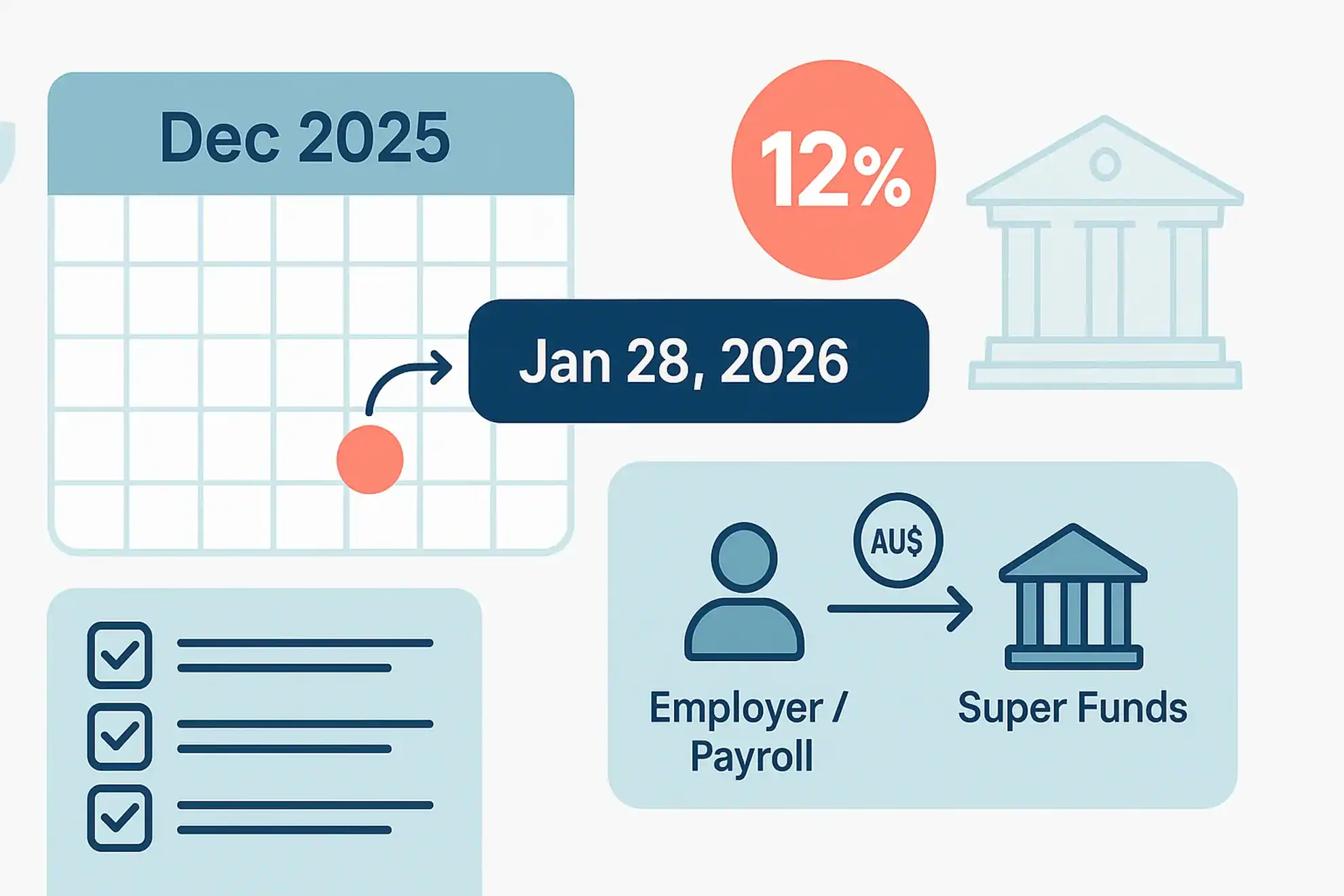

Reminder of December 2025 Quarter Superannuation Guarantee (‘SG’)

As noted in the previous article, employee December 2025 Quarter Superannuation Guarantee must be received by the relevant super funds by 28 January 2026. If the correct amount of SG is not paid by an employer on time, they will be liable to pay the SG charge, which includes a penalty and interest component. […]

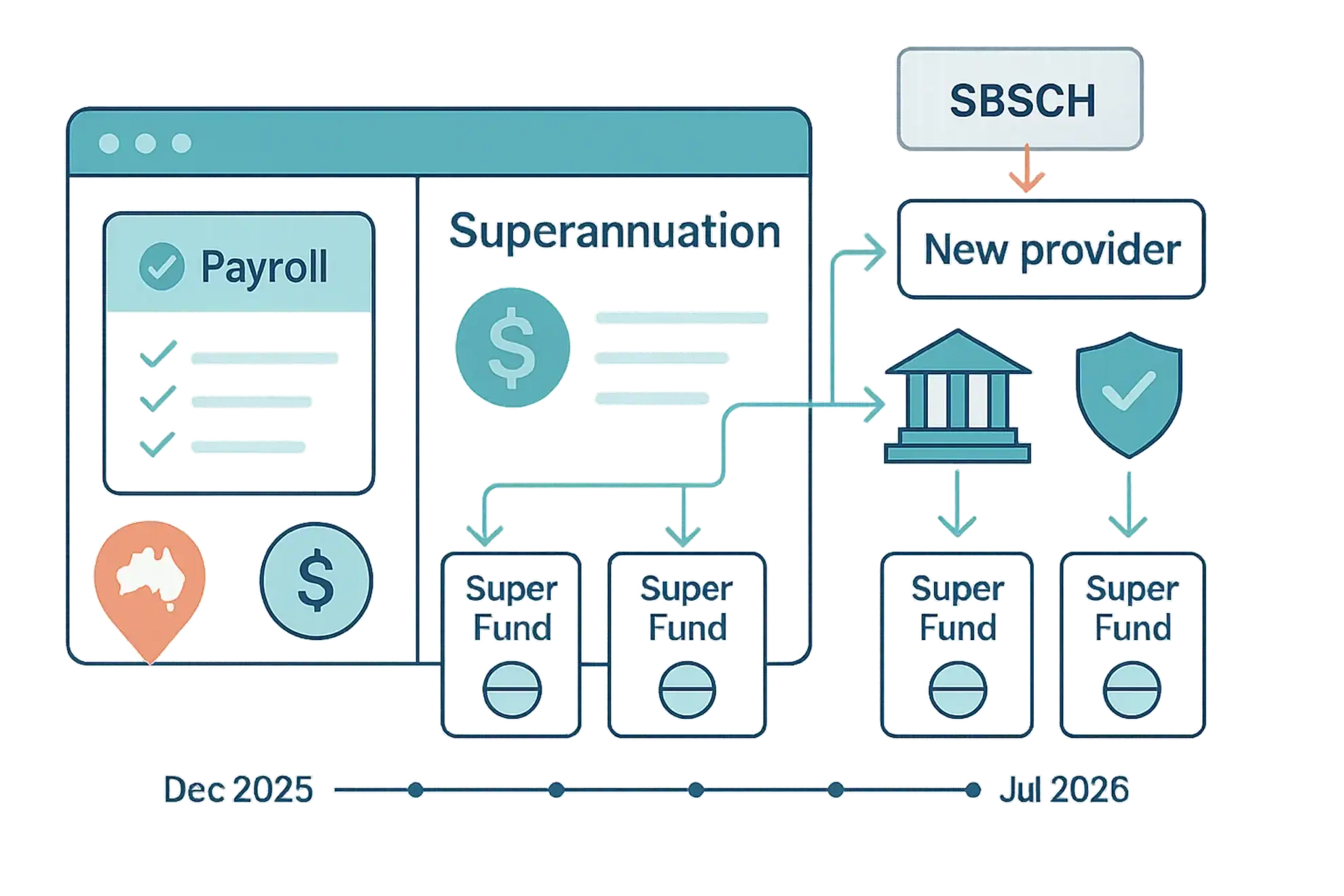

Alternative providers to the SBSCH

Employers should start preparing for the permanent closure of the Small Business Superannuation Clearing House (‘SBSCH’) on 1 July 2026. By acting now to find an alternative service, employers will: have an established process in place to pay super guarantee (‘SG’) for the March and June quarters (if they currently pay quarterly); reduce the risk […]

Division 7A Compliance … Are you prepared?

Division 7A is an integrity measure that was designed to prevent companies from making tax-free distributions to shareholders or their associates. This can occur where distributions of profit are disguised as loans or other transactions. This effectively allows the shareholder or their associate to have access to the corporate tax rate. A consequence of […]

Tax Return Tips

Before we sit down with you to go over your tax return, certain information will be needed. Of course, these days pre-filling takes care of a lot of the “paperwork”, and if you wait until late-July or mid-August the ATO’s systems will most likely be able to provide most of the information from employers, banks, […]

Simpler Stock Trading Rules For Those Starting Out In Business

If you are operating a small business and at the end of the income year you estimate that your trading stock’s value has not changed by more than $5,000, remember (especially if you are new to business) that you can choose not to conduct a formal stocktake. By making a decision to do this, you will not […]

Franchise Businesses and Tax

The Australian Competition & Consumer Commission (ACCC) is the government body responsible for enforcing the Franchising Code of Conduct, and if you or someone you know are considering a franchise business Australia, this will probably be a good starting point to get an idea of what to expect. The code imposes strict obligations on franchisors […]

Christmas Parties & Gifts 2025

Year-end (and other) staff parties Editor: With the well earned December/January, and Christmas parties & gifts 2025 on the way, many employers will be planning to reward staff with a celebratory party or event. However, there are important issues to consider, including the possible FBT and income tax implications of providing ‘entertainment’ (including Christmas parties) to […]

Alternative providers to the SBSCH

Employers should start preparing for the permanent closure of the Small Business Superannuation Clearing House (‘SBSCH’) on 1 July 2026. By acting now to find an alternative service, employers will: have an established process in place to pay super guarantee (‘SG’) for the March and June quarters (if they currently pay quarterly); reduce the risk […]