Latest News

Businesses using cash to dodge obligations

The ATO is ‘cracking down’ on businesses that use cash to dodge obligations on their tax, employer and business. Businesses that do this may: – fail to report all sales transactions and fail to issue receipts; – avoid paying GST, income tax, PAYG withholding, super guarantee, insurance and work cover protection; – report their income […]

$20,000 instant asset write-off extended

Editor: The Government recently passed legislation to extend the $20,000 instant asset write-off for small businesses by 12 months to 30 June 2026. Taxpayers should note that if their business has an aggregated annual turnover of less than $10 million, they may be able touse the instant asset write-off (‘IAWO’) to immediately deduct the business […]

Tax dodgers banned from leaving the country

The ATO is actively using departure prohibition orders (‘DPOs’) as part of a broader shift towards strengthening payment performance and debt collection. A DPO is an enforcement action available to the ATO to prevent certain persons with tax liabilities from leaving Australia without paying their outstanding tax. Since July 2025, the ATO has issued 21 […]

Paying super guarantee

The ATO is reminding employers that they must pay super guarantee (‘SG’) contributions for eligible employees. Employers need to pay a minimum of 12% (the current SG rate as from 1 July 2025) of each employee’s ordinary time earnings into a complying super fund on a quarterly basis (the due date for the March 2026 […]

Taxpayer’s dog breeding activities held to be an enterprise

The Administrative Review Tribunal (‘ART’) recently held that a taxpayer had carried on an enterprise of dog breeding for GST purposes. He had lodged activity statements for the quarters ended 30 September 2018 to 31 December 2021 inclusive, claiming input tax credits (‘ITCs’) for the dog breeding activities he carried on from his home (among […]

Time limits on GST and fuel tax credit claims

Taxpayers should note that GST credits and fuel tax credits will expire if not claimed within the 4-year credit time limit (i.e., generally four years from the due date of the original BAS in which the taxpayer could have claimed them). Once credits expire, the ATO has no discretion or ability to amend the assessment […]

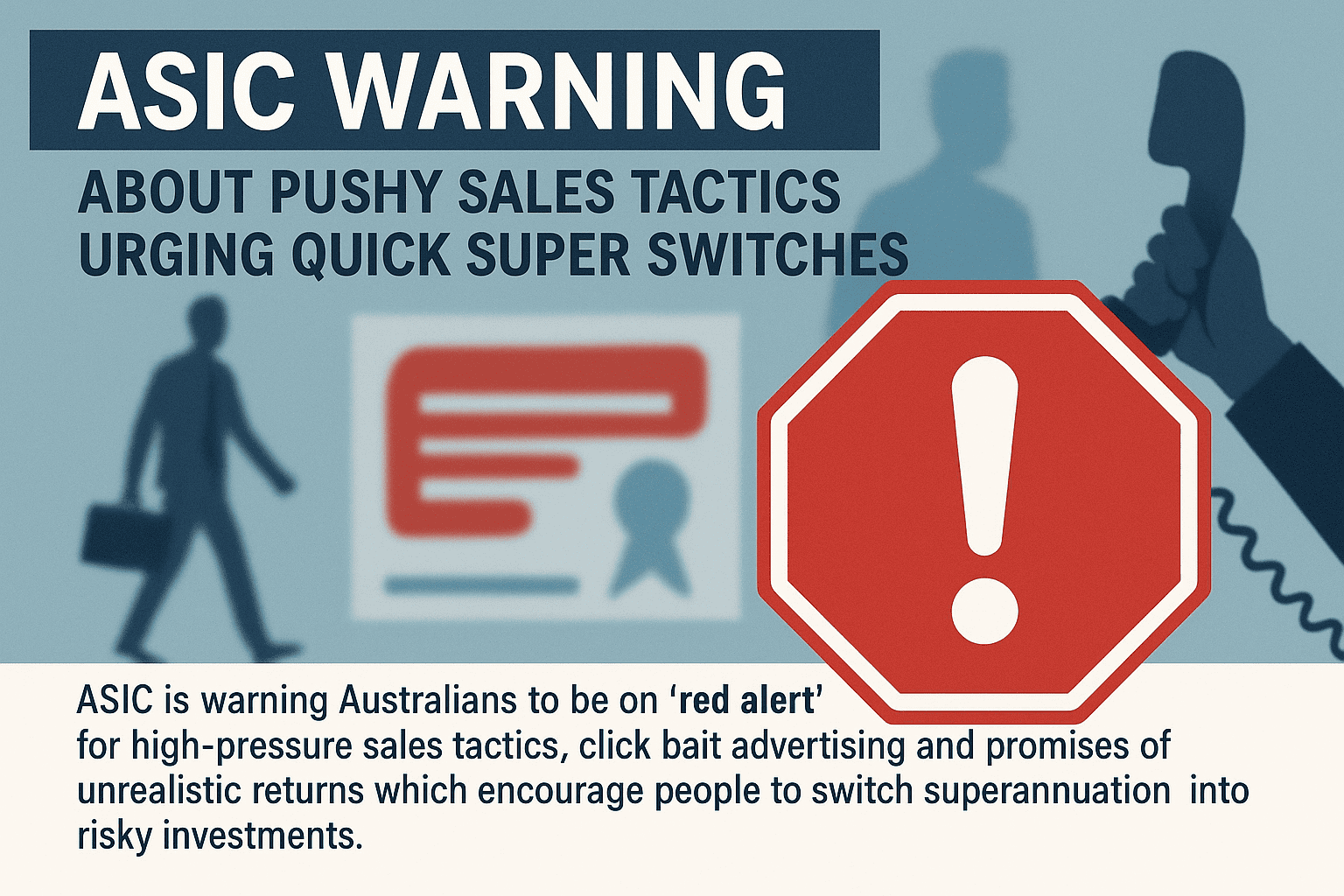

ASIC warning about pushy sales tactics urging quick super switches

ASIC is warning Australians to be on ‘red alert’ for high-pressure sales tactics, click bait advertising and promises of unrealistic returns which encourage people to switch superannuation into risky investments. The warning comes amid increasing concerns from ASIC that people are being enticed to invest their retirement savings in complex and risky schemes. ASIC Deputy […]

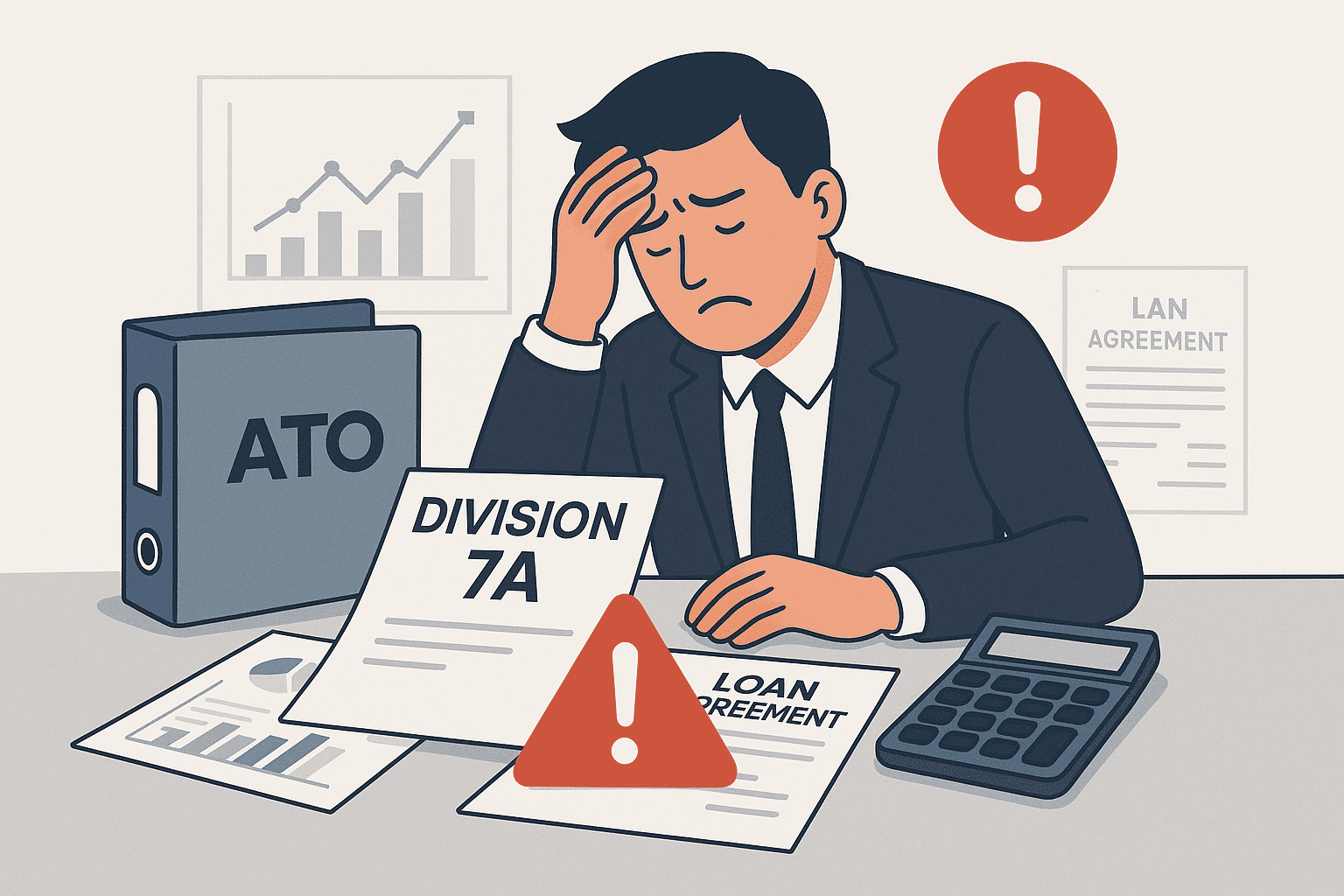

ATO warns of common Division 7A errors

The ATO reminds shareholders of private companies that understanding how Division 7A of the tax legislation applies is crucial to avoiding costly tax consequences when accessing the company’s money or other benefits. When Division 7A applies, the recipient of a payment, loan or other benefit can be deemed to have been paid an unfranked dividend […]

Taxpayers who need to lodge a TPAR

Taxpayers may need to lodge a Taxable payments annual report (‘TPAR’) online by 28 August if they have paid contractors to provide any of the following services on their behalf: building and construction; cleaning; courier and road freight; information technology; or security, investigation or surveillance. If the ATO is expecting a TPAR from a taxpayer […]

Changes to tax return amendment period for business

Businesses with an annual aggregated turnover of less than $50 million now have up to four years from the date of their tax return assessment to request amendments (increased from two years). This applies to assessments for the 2024/25 and later income years. If businesses make a mistake on a tax return amendment, they should […]

Taxpayer’s claim for travel expenses denied

In a recent decision, the Administrative Review Tribunal (‘ART’) denied an offshore worker’s claim for work-related travel expenses, although it did allow his claim for home office expenses. During the relevant period, the taxpayer resided in Queensland with his family, while his employment as an engineer was primarily based at an offshore facility located off […]

ATO to include tax ‘debts on hold’ in taxpayer account balances

From August 2025, the ATO is progressively including ‘debts on hold’ in relevant taxpayer ATO account balances. Editor: A ‘debt on hold’ is an outstanding tax debt where the ATO has previously paused debt collection actions. Tax debts will generally be placed on hold where the ATO decides it is not cost effective to collect […]