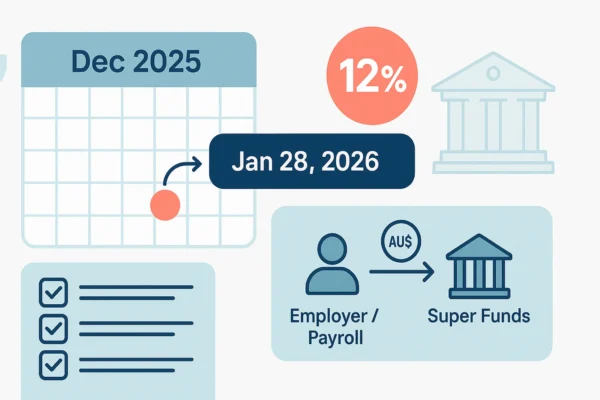

As noted in the previous article, employee December 2025 Quarter Superannuation Guarantee must be received by the relevant super funds by 28 January 2026.

If the correct amount of SG is not paid by an employer on time, they will be liable to pay the SG charge, which includes a penalty and interest component.

The SG rate is 12% for the 2026 income year (increased from 11.5% for the 2025 income year).

For personalised guidance on year‑end entertainment and gifting rules, please contact Taxwise Australia and review practitioner registration details via the Tax Practitioners Board.